A pan-African fintech focuses on enhancing the cross-border payment experience through redesigning for user centricity

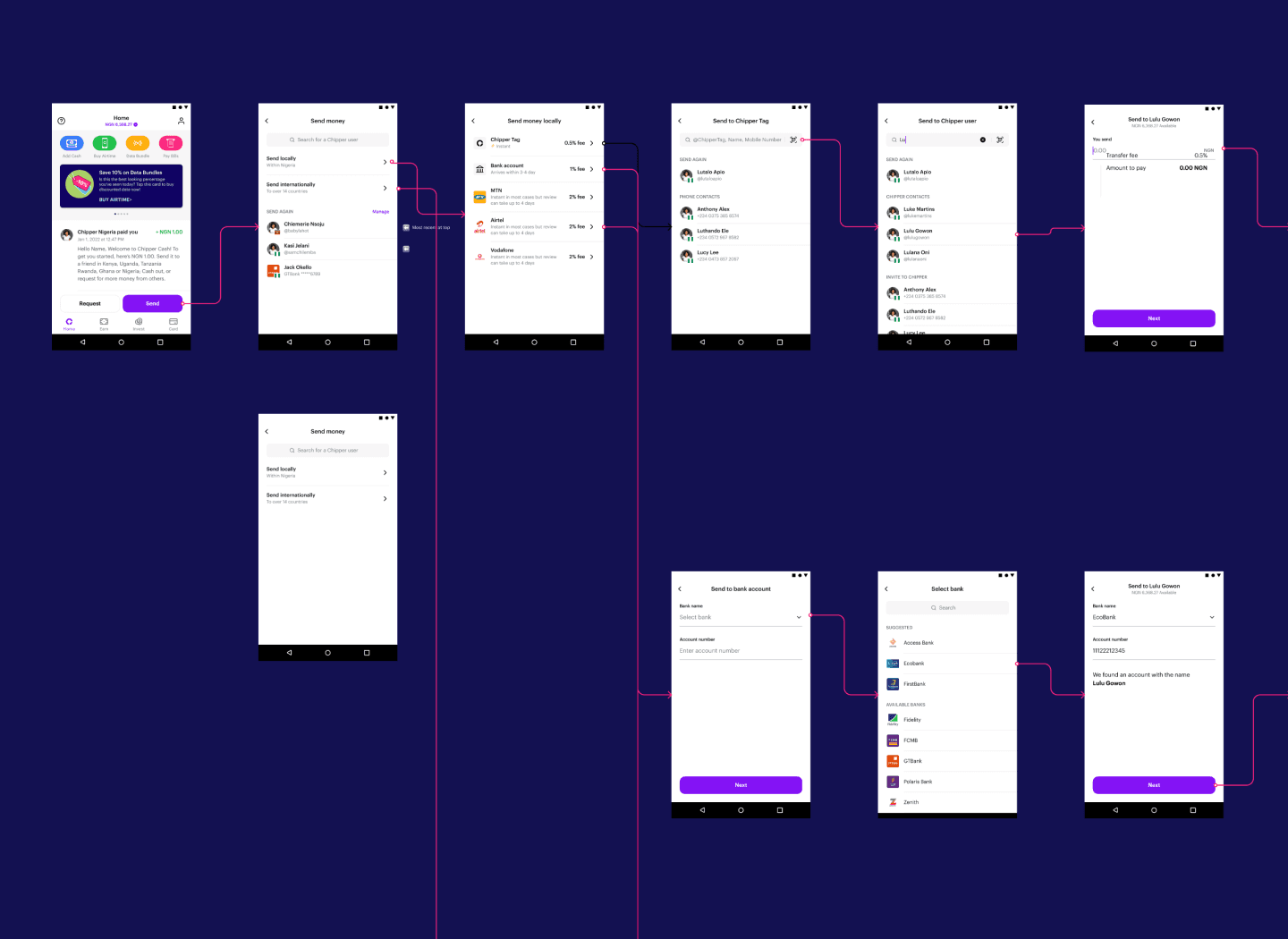

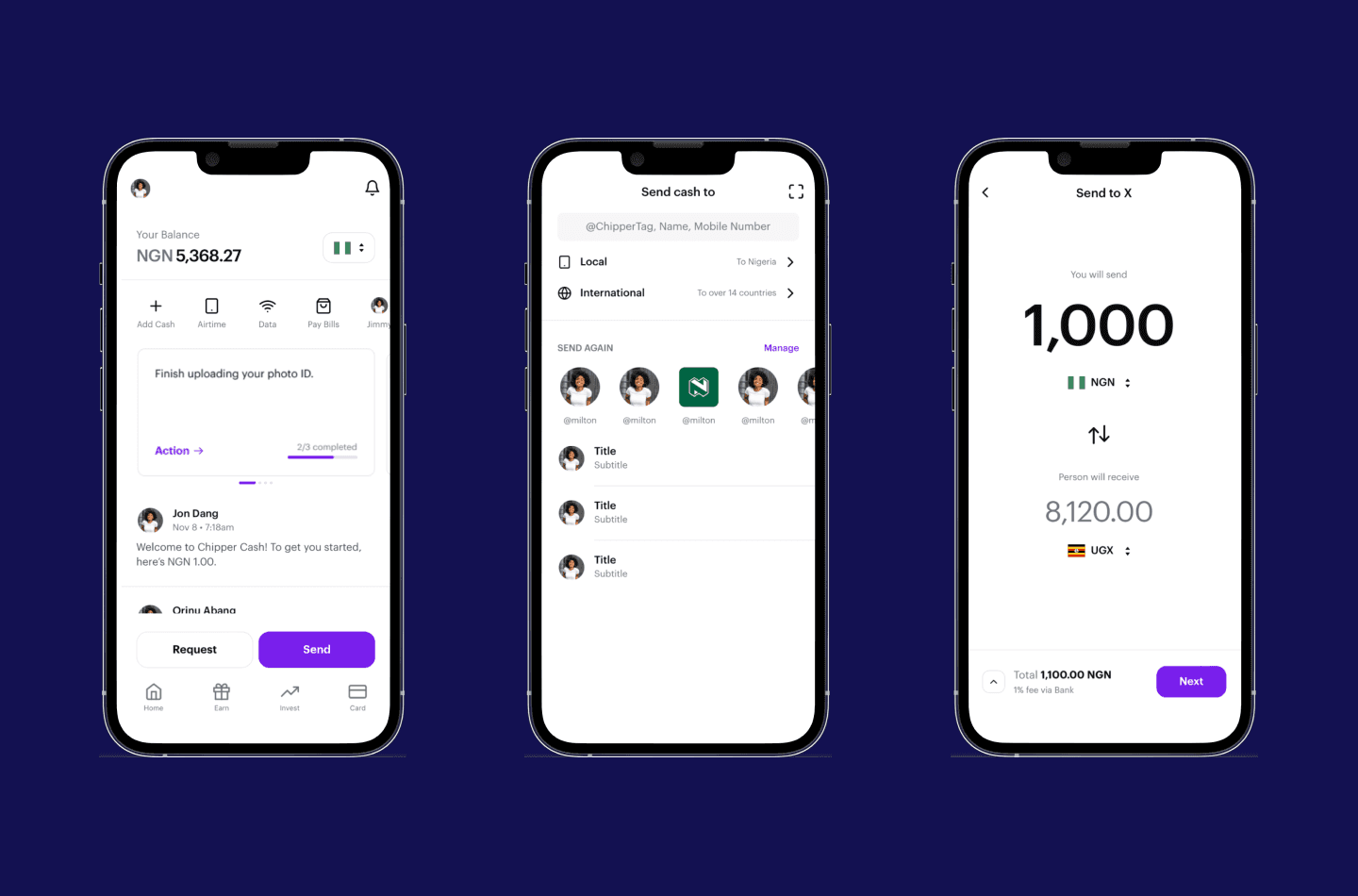

Early user flows depict the original "Send" cross-border functionality. Note the "color soup" on the home screen (far left), which often contributed to user confusion regarding next steps.

Chipper Cash is a fintech platform that offers mobile, cross-border money transfer services for Africans and the African diaspora worldwide. At the time, the ability for customers to easily send money cross border was the most crucial for the business. During their rapid expansion, Chipper concentrated deeply on product development. As they ventured into new markets however, we quickly noticed an increase in drop offs after users reached the home screen. Recognizing the need for more intuitive usability and design, we embarked on a “Chipper 2.0 initiative” to redesign the “Home” and “Send Money” user flows.

International remittances terminating in mobile-money wallets grew by 65 percent year over year in 2020 to around $1 billion

Digital wallets that are linked to a variety of payment methods, including cards, accounts, and mobile money, are growing in availability and adoption.

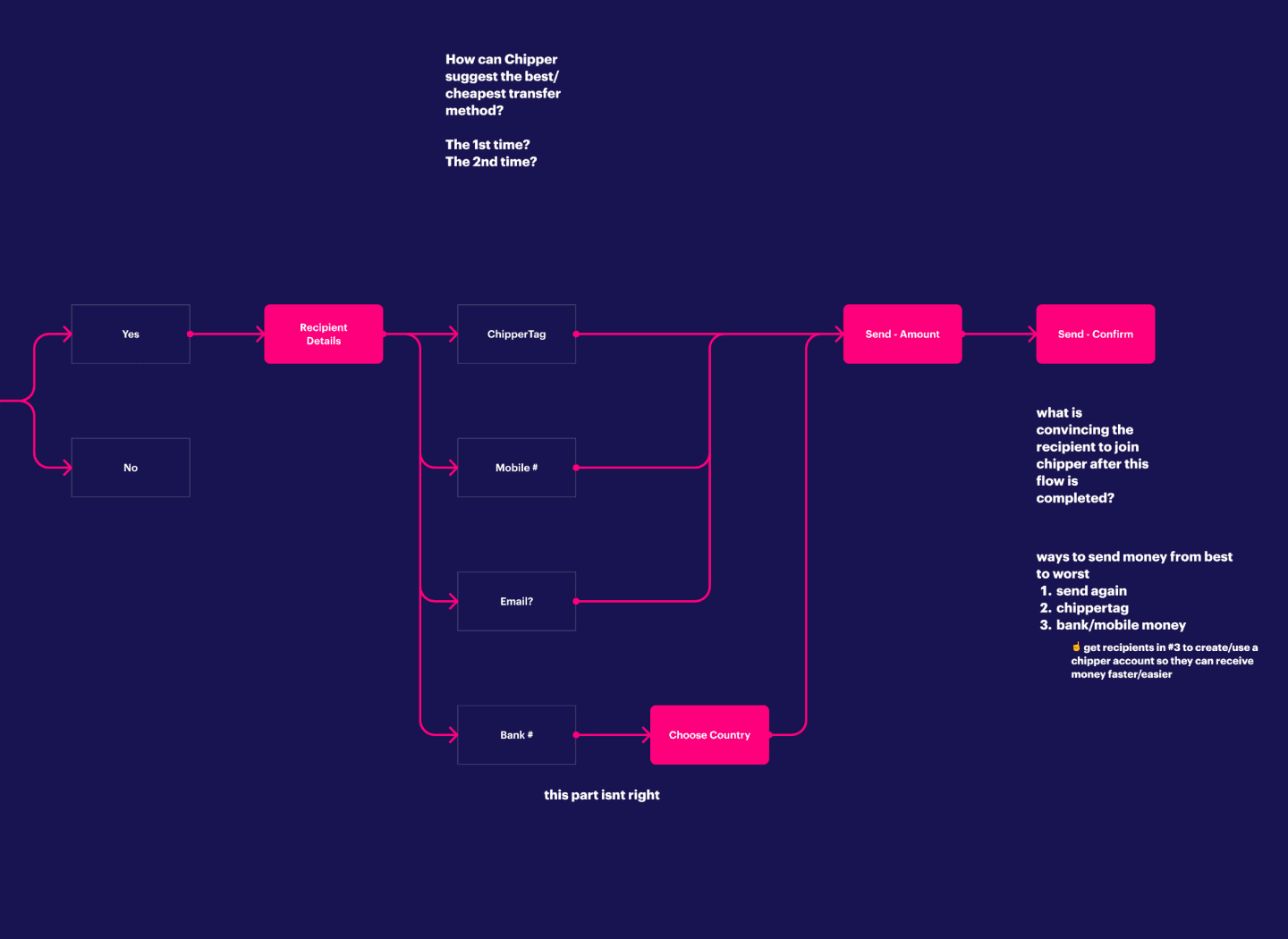

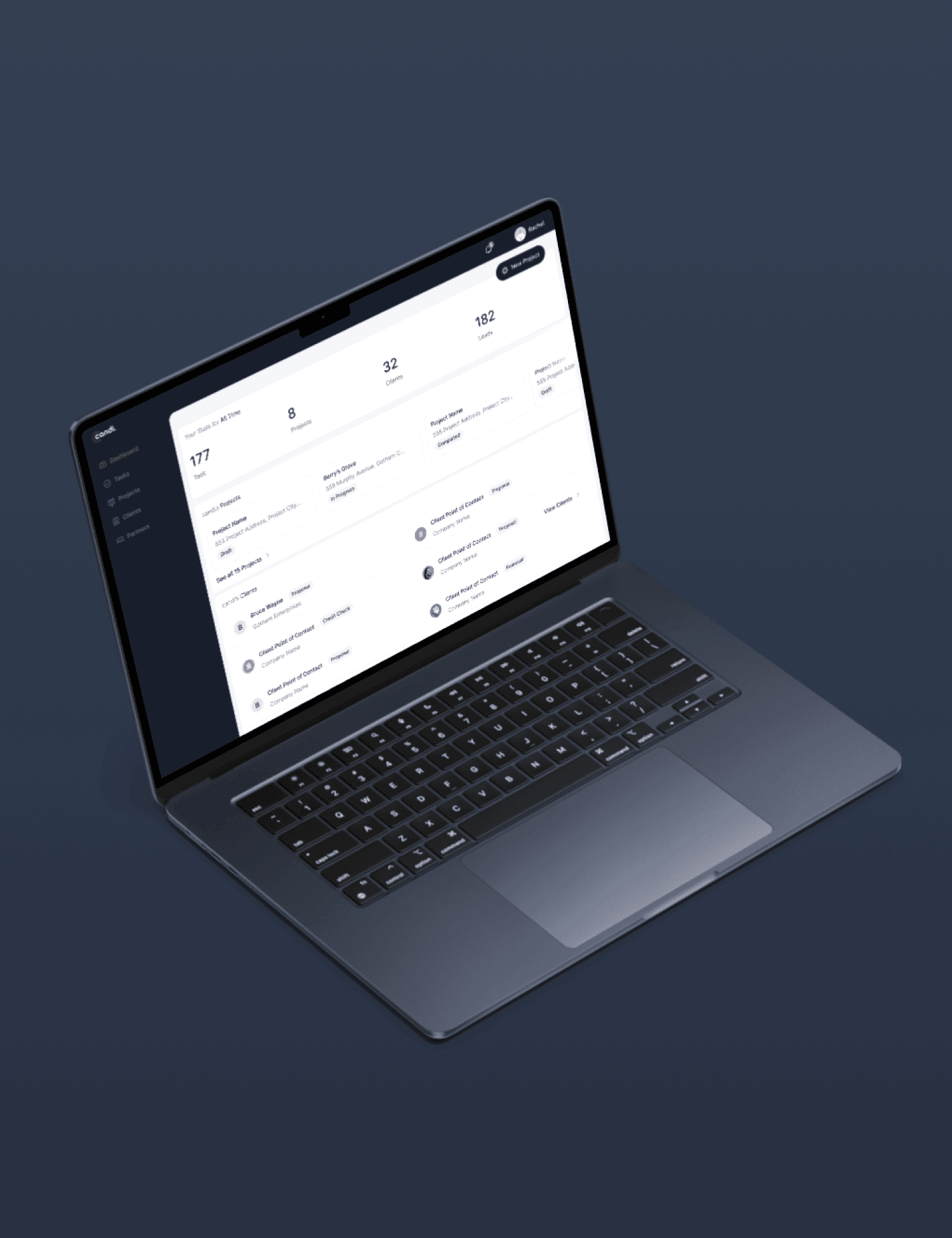

We started the process of mapping new user flows, focusing on improving cross-border transfer experiences and integrating UI/UX features to suggest the most affordable or efficient methods.

To address this, we engaged in extensive user research across Nigeria and Uganda, eventually narrowing our focus to Ugandan freelancers due to the market's stability. Across all the user groups we interviewed: students, suppliers, salaried employees, agents, and parents, freelancers particularly benefitted from Chipper's fast remittances. These customers often have employers or clientele from different countries, were more tech savvy (owned a smartphone), and wanted more ways to invest and spend.

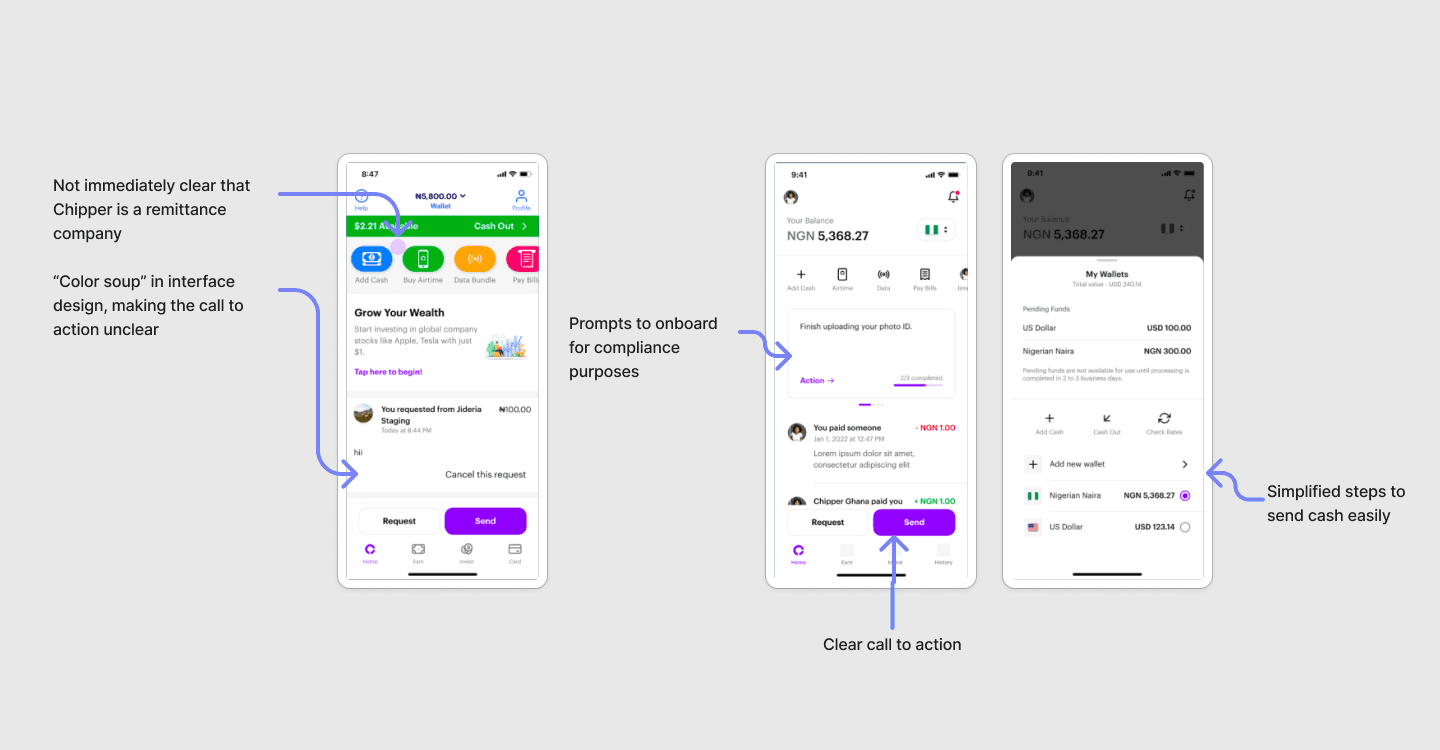

Before and after comparison of the original "Send" home screen, vs. "Send 2.0"

Our insights highlighted elements of the app that were most important to Chipper users. The majority of customers emphasized the need for clearer fee displays and payment summaries prior to confirming the transaction. Now with clear design requirements in mind, we were able to reimagine what it might look like for the Chipper app to better serve these freelancers.

Building “Chipper 2.0” required stakeholder buy-in from all departments: product, marketing, engineering, revenue. We implemented a new and rigorous iteration process that kept user experience at the forefront of our designs, and also maintained alignment with all cross-functional leaders. The new version aimed for simplicity and efficiency in fund transfers, addressing compliance needs, and using visual cues to prompt users towards a clear “call to action.” As a result, the project culminated in the successful deployment that all teams were proud of. The final design was simpler, easier to navigate, and guided users towards a smoother journey to send their funds.

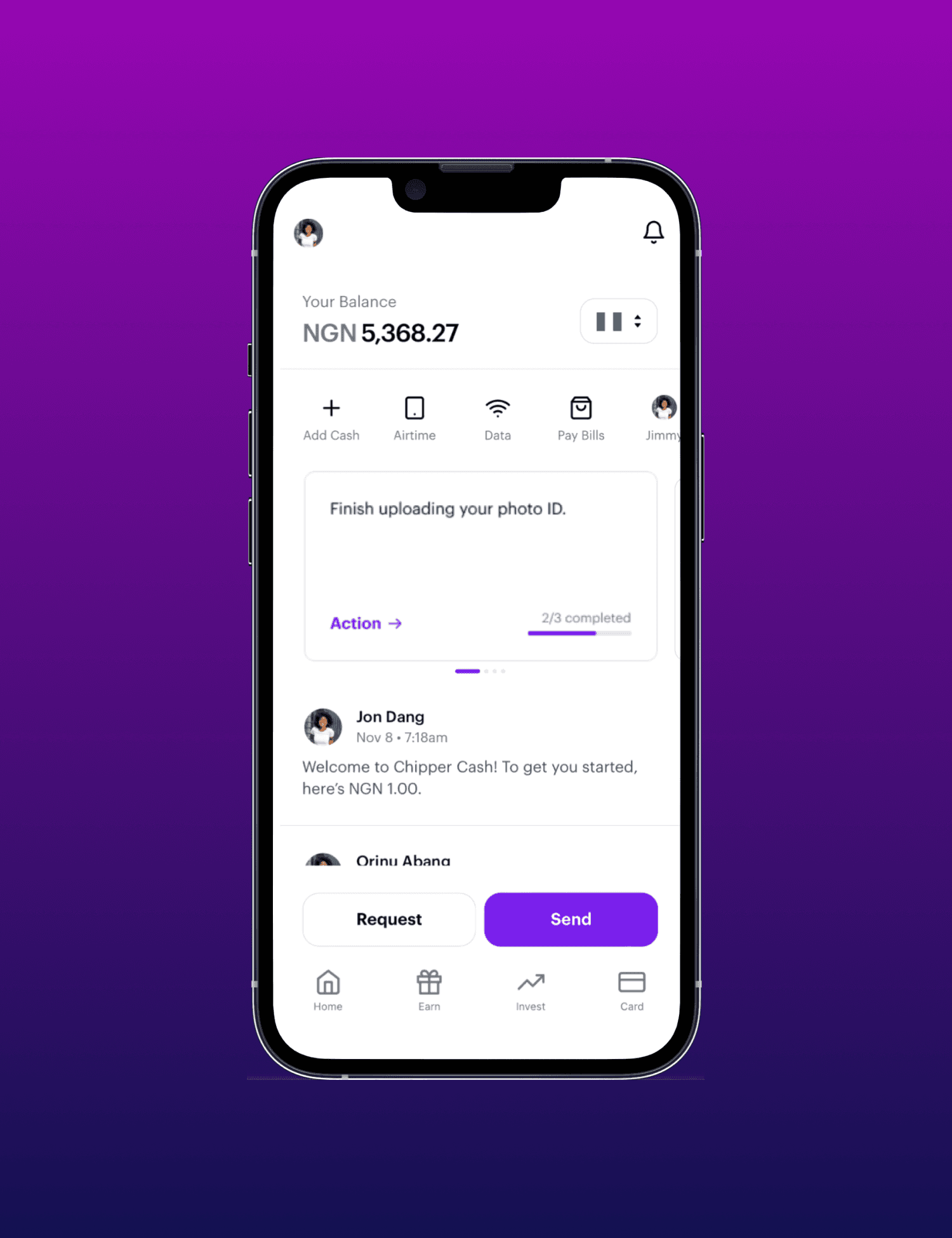

Final design of Chipper's "Send 2.0," with a clean user journey and aesthetic we were all proud of 🙂